Cybersecurity Almanac

A Record $119B in Strategic Activity Across Acquisitions, IPOs & Financings; Strategic Buyers’ Domination; and an Emerging Two-Tier Market

Total M&A Deal Value

M&A Transactions

YoY M&A Deal Value Growth

YoY M&A Deal Volume Growth

M&A Deals Completed by PEs

Of M&A Capital Was Deployed By Strategics

Number Of Billion Dollar M&A Deals

Financing Rounds In 2025

Cybersecurity Financing Reached $20.7B, Up 52% From 2024

Record-Breaking

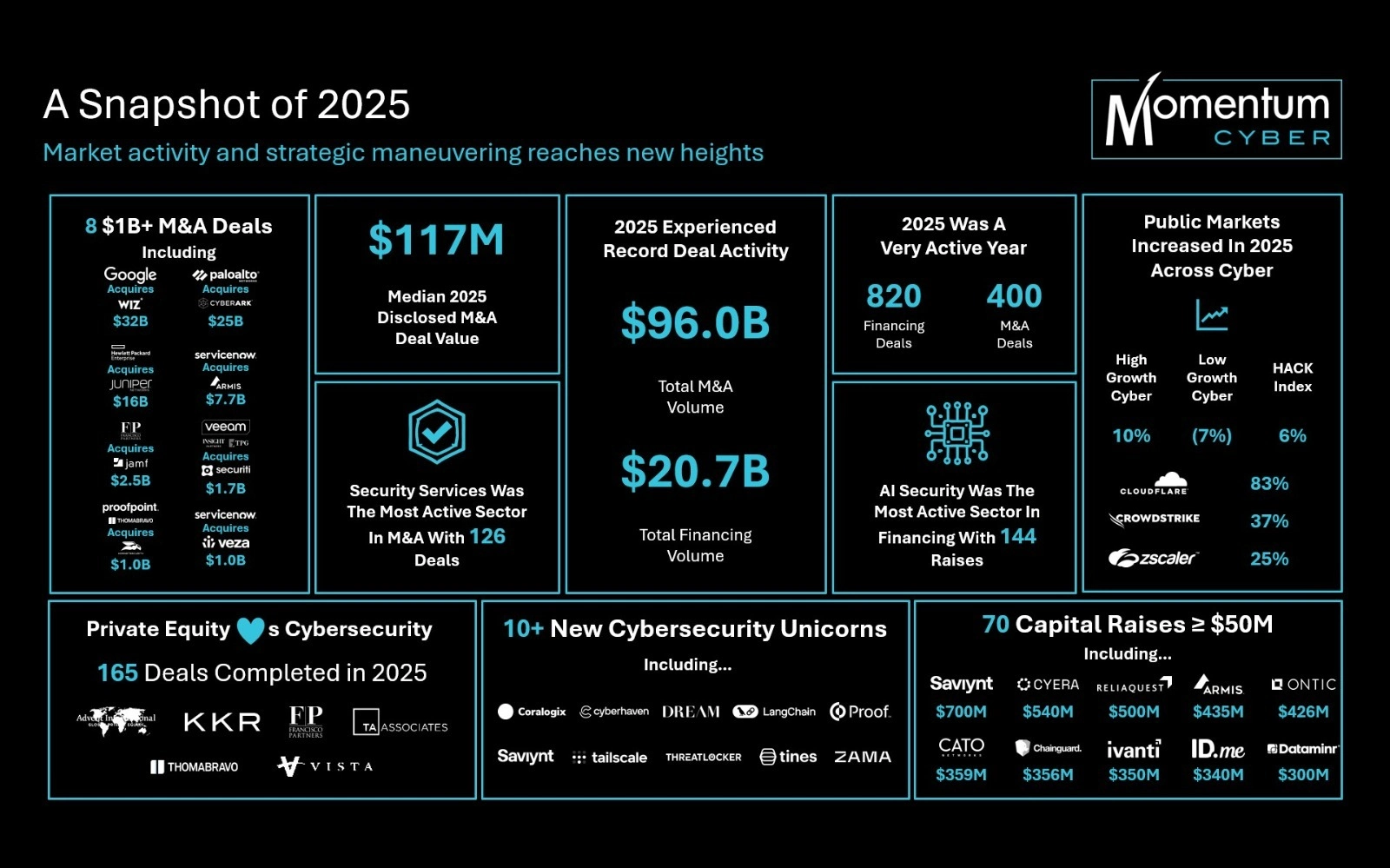

The cybersecurity sector experienced unprecedented deal activity in 2025, with both deal volume and deal value reaching all-time highs. Strategic buyers returned in a big way, deploying capital across identity and access management, cloud security, and data security initiatives. This comprehensive report tracks the complete landscape of cybersecurity mergers and acquisitions throughout the year—providing unmatched insights into deal velocity, buyer activity, transaction values, and emerging trends across all subsectors.

Key Report Takeaways

Mega Deals Reignite Market

- Mega-cap cybersecurity M&A returned in force, with 8 transactions exceeding $1B and 38 deals surpassing $100M, signaling renewed buyer confidence and a re-acceleration of large-scale consolidation.

Strategic Buyers Dominant

- Strategic acquirers account for 92% of disclosed M&A capital deployed, with strategics back at their highest activity level on record. Private equity remains active with 165 deals completed, while platform consolidation accelerates.

SaaS Transactions Surge

- Cybersecurity SaaS M&A transactions reached record highs, with 235 SaaS companies traded representing 97% of total M&A capital deployed. Deal volume grew at a 22% CAGR since 2019, reflecting market consolidation.

Financing Momentum Sustained

- Cybersecurity financing reached $20.7B across 820 deals, up 52% from 2024. AI-driven startups and risk & compliance platforms attracted the strongest venture capital interest in 2025 as investors back scaling opportunities.

Detailed

Cybersecurity M&A Transactions by Sector

- Security Services: 126 deals – The most active sector for M&A. Reflects continued demand for managed services and consulting expertise across enterprises.

- Risk & Compliance: 63 deals – Private sector organizations and strategic buyers prioritizing governance and risk management frameworks.

- Cross-Border Transactions: 40% of M&A activity was cross-border, with Israel remaining a significant source of innovative cybersecurity companies.

- Cloud Security: Highest deal value, led by Google’s Wiz acquisition, reflecting the strategic importance of cloud infrastructure protection.

Financing Activity & Venture Capital Trends

- Total Funding Volume: $20.7B across 820 deals—a 52% increase from 2024.

- Series C+ Growth: Median deal size increased from $50M in 2023 to $80M+ in 2025, showing strong investor interest in scaling opportunities.

- AI Security Dominance: Artificial intelligence-driven startups commanded premium valuations and attracting institutional capital.

- PE Investment Surge: Private equity deployed over twice as much capital in cybersecurity in 2025 compared to 2023.

Strategic Buyer and Investor Landscape

- Most Active Strategic Buyers: Palo Alto Networks, Google, Check Point, Accenture, and Zscaler led acquisition activity.

- PE Platform Dominance: Thoma Bravo, Vitruvian Partners, TA Associates, and Advent International remained highly active with portfolio company acquisitions.

- Buyer Focus Areas: Strategic buyers concentrated on cloud security, identity management, data security, and AI-powered threat detection capabilities.

2026 Cybersecurity Market Outlook & Predictions

- Continued Consolidation: Identity security, cloud infrastructure, and AI-driven threat detection will remain focal points for M&A activity.

- AI as Defense & Attack Vector: Artificial intelligence will drive both innovative security solutions and new threat surfaces, creating sustained demand for cybersecurity acquisitions.

- IPO Window Opening: With Netskope and SailPoint achieving public status, multiple cybersecurity unicorns are positioned for public markets in 2026.

- Healthy Pipeline Ahead: Strong venture capital funding, robust strategic buyer interest, and continued cyber resilience investment signal a healthy pipeline of scaling opportunities.

- Government & Defense Growth: Record government cybersecurity budgets and increased defense sector investment will fuel growth in specialized vendors.

CYBERcloud

Founded on deep sector expertise and institutional knowledge, Momentum Cyber maintains the industry’s most comprehensive proprietary M&A and financing transaction database—CYBERcloud—which tracks over 6,000 cyber companies and represents millions of data points spanning decades of cybersecurity sector intelligence.

About

The Premier Trusted Advisor to the Global Cybersecurity Ecosystem

Momentum Cyber is the leading investment banking and advisory firm exclusively focused on the cybersecurity sector. With unparalleled access to cyber executives, board members, investors, and CISOs, Momentum Cyber serves as the trusted advisor to founders, CEOs, and industry decision-makers navigating mergers and acquisitions, financing, and strategic advisory.

Founded on deep sector expertise and institutional knowledge, Momentum Cyber maintains the industry’s most comprehensive proprietary M&A and financing transaction database—CYBERcloud—which tracks over 5,000 cyber companies and represents millions of data points spanning decades of cybersecurity sector intelligence.

J. Eric McAlpine

Founder & CEO, Managing Partner

“Founders deserve the absolute best in overall investment banking services, industry knowledge, relationships, and senior-level experience. In the complex cybersecurity ecosystem, no other firm offers a higher set of skills, expertise, and mission-critical advice to leading Founders & CEOs and industry decision-makers.”

4,000+

Strategic & Investor Contacts

68+

Cyber Transactions

$25B+

Cybersecurity Deal Value twice.

2,000+

Leading CISOs

Database Leadership

CYBERcloud: Industry-Leading Transaction Database

Market Position

Unrivaled Thought Leadership & Original Research